The 2025 Wallenberg Lecture: 'Decarbonisation Commitments: Signals, Substance, or Spin?'

The 2025 Wallenberg Lecture was delivered on 6 November by Professor Marcin Kacperczyk (Imperial College London and ECGI), titled “Decarbonisation Commitments: Signals, Substance, or Spin?”

The lecture offered a timely examination of how financial markets interpret corporate net-zero pledges amid growing scrutiny of climate disclosures. Drawing on his research in sustainable investment and climate finance, Professor Kacperczyk assessed the credibility and economic implications of decarbonisation strategies, highlighting the tension between genuine transition efforts and symbolic signalling. He showed how governance, regulation, and market dynamics shape the valuation and impact of firms’ climate commitments.

The discussion was enriched by commentary from Professor Estelle Cantillon (Université libre de Bruxelles), who emphasised the role of market design, incentives, and institutional frameworks in evaluating climate actions across sectors and jurisdictions.

Hosted by the Solvay Brussels School in partnership with ECGI and supported by Helios Foundation, the event brought together academics, policymakers, and practitioners for a rigorous debate on the evolving landscape of climate finance.

Access the presentation slides here.

Video Timeline Summary

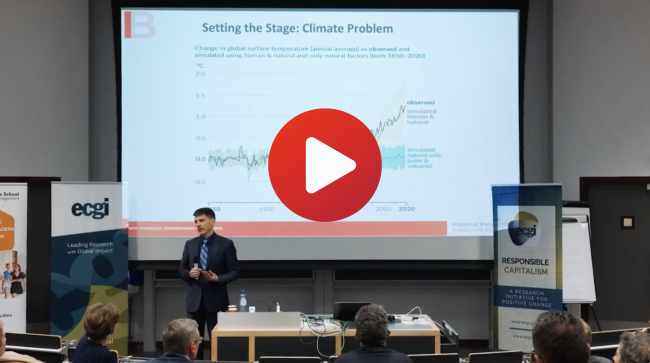

- The lecture begins by establishing that global warming is accelerating and is almost entirely driven by human activity.

- The speed and magnitude of temperature increases cannot be explained by natural variability.

- This scientific consensus forms the foundation for analysing whether corporate commitments can meaningfully reduce emissions.

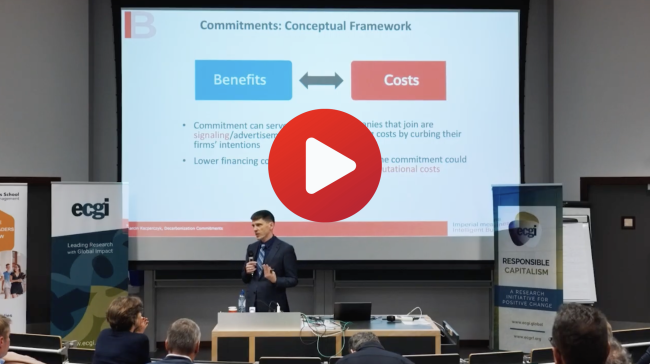

- The discussion explains that commitments arise because global carbon pricing is politically impossible.

- Nationally Determined Contributions under the Paris Agreement now cover most global emissions, creating a patchwork accountability model.

- Corporate commitments expand rapidly, signalling a shift in expectations about how firms should respond to climate risks.

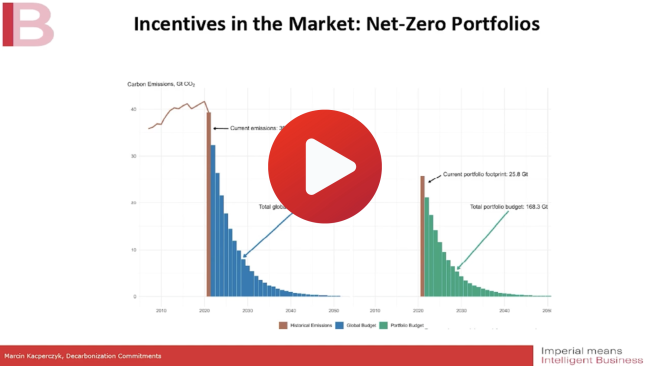

- Most corporate targets are short-term and far below what scientific models require for a 1.5°C or even 2°C pathway.

- Only a small minority commit to full decarbonisation; most pledge modest 10–20% reductions over narrow horizons.

- This mismatch raises the question of whether the commitments are meaningful or merely symbolic.

- The data present a central empirical contradiction: global commitments increase, yet global emissions also increase.

- A positive correlation emerges between the two — the opposite of what effective climate action would imply.

- This paradox becomes the central question: why do growing pledges fail to produce aggregate decarbonisation?

- At the firm level, companies that make commitments tend to reduce emissions in the years following their pledge.

- These reductions are real but relatively small because committing firms are typically low emitters to begin with.

- Meanwhile, major emitters — the companies that matter most — rarely commit and often continue increasing emissions.

- Firms hesitate to commit because failing publicly creates reputational and legal risks.

- Those that do pledge often manipulate “base years” by choosing periods with historically high emissions, making future reductions appear larger.

- These behavioural adaptations reveal how commitments become risk-managed corporate products rather than strict decarbonisation tools.

- Over 70% of firms fall behind the decarbonisation trajectory implied by their targets.

- Under-delivery stems from technological limitations, capital requirements, exposure to shocks (e.g., energy crises, war), and complex value chains.

- The problem reflects structural constraints rather than intentional greenwashing.

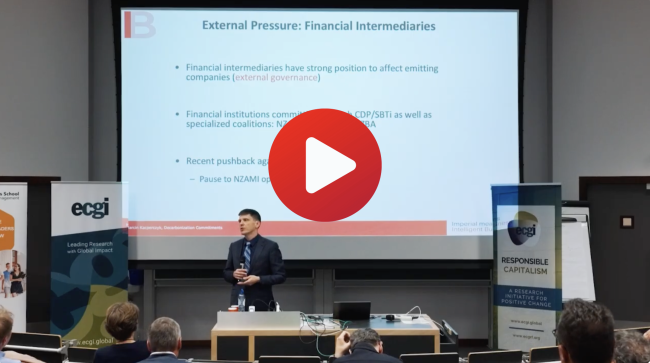

- Banks that join climate alliances restrict lending to high-emitting companies.

- These restrictions raise financing costs for carbon-intensive borrowers as expected.

- Borrowers respond by cutting low-profit projects rather than high-emission ones, improving profitability but not reducing emissions.

- Net Zero Asset Managers grows from USD 9 trillion to over USD 60 trillion in commitments, becoming a major coordination force.

- By 2025 the initiative still oversees USD 57.5 trillion, but withdrawals by BlackRock, JPMorgan and others destabilise the coalition.

- The near-collapse of the alliance shows how fragile voluntary coordination is when political conditions harden.

- Updated global projections show that even optimistic pathways exceed the 1.5°C target.

- More realistic expectations point to 2–3°C warming, with some regions facing extreme increases of 8–10°C.

- This outcome reflects a world where commitments multiply but incentives remain misaligned, and where voluntary coordination cannot withstand geopolitical strain.

- The discussant, Professor Estelle Cantillon (Université libre de Bruxelles), highlights the need for stable disclosure rules, stronger accountability mechanisms, and coordinated action.

- Audience questions explore California’s climate reporting laws, IFRS sustainability standards, China’s trajectory, energy technology shifts, and competitiveness concerns.

- The session ends by emphasising that climate progress requires coordinated governance rather than voluntary pledges alone.