The ECGI Finance Editorial Board

The Finance Editorial Board is responsible for the selection of the best paper in the series annually along with admitting papers from ECGI research members or those presented at ECGI events for inclusion in the ECGI - SSRN Working Paper Series. Visit the FAQ page for more information about how to submit papers to the Working Paper Series.

Composition

Editor | Appointed: 2024

Appointed: 2002

Appointed: 2022

Appointed: 2022

Appointed: 2015

Appointed: 2002

Responsibilities

The Working Paper Editorial Boards are responsible for the selection of the prize for the best papers in each series annually. The methodology and timeline for this process is determined by the series editor in agreement with their respective boards and overseen by the ECGI secretariat.

Outside of this function, the editor may periodically consult their board on whether a paper is eligible or suitable for the ECGI working paper series. They must also obtain the agreement of another board member in order to accept a paper authored by the series editor.

General guidelines (see more here)

The WP series editors generally apply a broad definition of corporate governance and also include papers on the interface between corporate governance and other areas, or papers of which only a part touches on corporate governance. However, papers in other areas whose relevance for corporate governance is only indirect or methodological will not be included. Examples of papers that will be accepted include works:

- covering topics of financial regulation that have an impact on how firms are, or should be, governed/managed/owned;

- dealing with the financial crisis, when implications can be drawn on how financial institutions are, or should be, governed/managed/owned.

Examples of papers in other areas whose relevance for corporate governance is only indirect or methodological include:

- contributions to banking and financial institutions that do not address governance issues;

- macroeconomic discussions of the financial crisis, sovereign debt markets or related phenomena that do not explicitly address the governance of firms or financial intermediaries.

The ECGI Working Paper Series are intended for works in progress (i.e., not for already published pieces). The acid test for inclusion is whether the paper could be published in a scholarly journal. As such, the main focus is on research papers. Essays, longer surveys or handbook chapters will typically also be included. Comments, op-ed pieces, cases, or teaching notes will not be included.

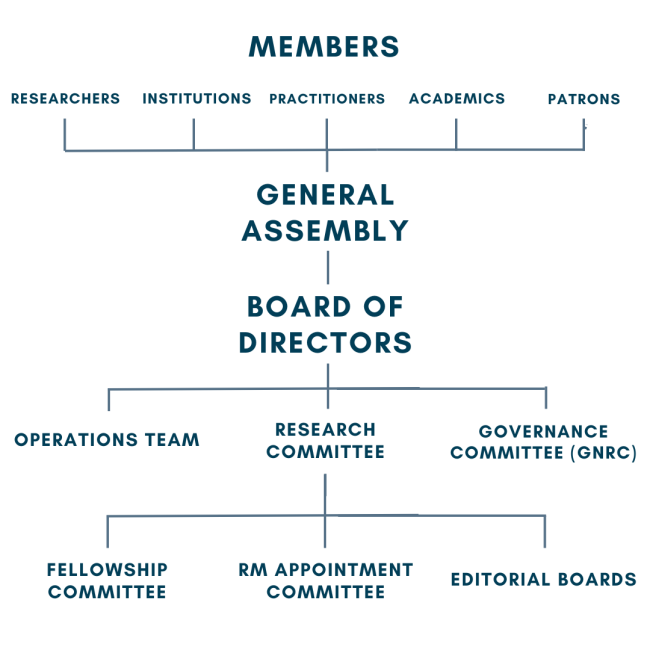

Composition

The Editorial Board will have a minumum of six members, with no maximum limit. The Board should aim to include a variety of representation geographically. The members will be invited from the ECGI network by the series editor.

Quick links

The Global Corporate Governance Colloquia (GCGC)

GCGC is a partnership of 12 leading universities from Asia, Europe and the US which convenes annually with papers and participants from the fields of law and finance. ECGI is responsible for the general operation of GCGC and organisation of the annual conference.

The European Corporate Governance Research Foundation (ECGRF)

ECGRF is a charitable foundation which was established to provide long-term support for ECGI. ECGI reports annually to the Trustees of the Foundation and manages its general operations.