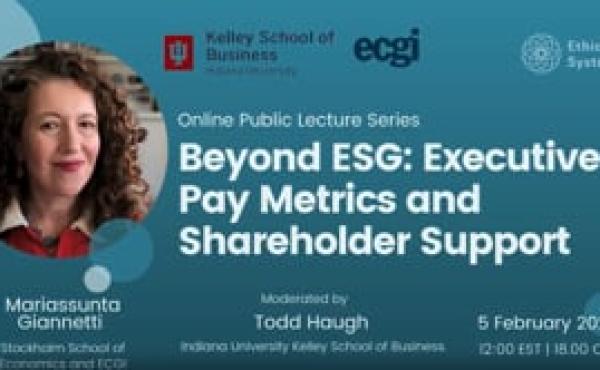

Beyond ESG: Executive Pay Metrics and Shareholder Support

Key Finding

Increase in ESG metrics has been accompanied by a higher propensity to use operating metrics

Abstract

Using a novel global dataset of executive pay contracts, we show that the surge in ESG and other compensation metrics is more about securing shareholder consent than directing managerial effort. ESG metrics – classified according to SASB standards – are often added in areas of existing strength, with negligible impact on overall ESG outcomes. Instead, metrics of any type are added after high say-on-pay dissent and are often chosen to align with proxy advisors’ preferences. Using quasi-random variation arising from metric usage at ISS marginal peers and marginal non-peers, we show that pay metrics increase say-on-pay approval and reduce both shareholder proposals and shareholder dissent on managerial proposals, without affecting a firm’s information environment. These findings challenge contract theory’s prediction that metrics are selected to direct attention to neglected objectives and suggest that the surge in ESG and other metrics reflects the desire to appease shareholders.