The ECGI blog is kindly supported by

Shareholders in a Disrupted World: Final Reflections and Insights from the 2025 ECGI IESE Conference

The Shifting Landscape of Responsible Investment

The 2025 ECGI IESE conference on "Shareholders’ Role and Responsibilities in Times of Corporate Disruptions” held in Madrid on 31 March 31 2025, highlighted the dramatic shift in ESG investing following the November 2024 US election. What was once a growing consensus around responsible investment has been significantly disrupted in just a few months, creating new challenges and opportunities for shareholders.

Despite 2024 being the warmest year on record with devastating climate disasters affecting the United States and beyond, the new administration swiftly withdrew from the Paris Agreement and reversed policies on phasing out coal. These actions came as atmospheric CO₂ concentrations reached new all-time highs above a concerning 431 ppm, with global temperature records being repeatedly broken.

The Great Divergence: Asset Managers vs. Asset Owners

Perhaps the most striking development has been the divergence between asset managers and asset owners in their response to the new political landscape. Major asset management firms have rapidly retreated from climate commitments through multiple channels:

- Withdrawing from climate initiatives including the Net Zero Asset Managers initiative, which subsequently suspended operations;

- Explicitly disavowing the use of stewardship to achieve decarbonization goals;

- Rebranding climate-focused funds and weakening ESG criteria;

- Dramatically reducing or eliminating support for environmental shareholder proposals.

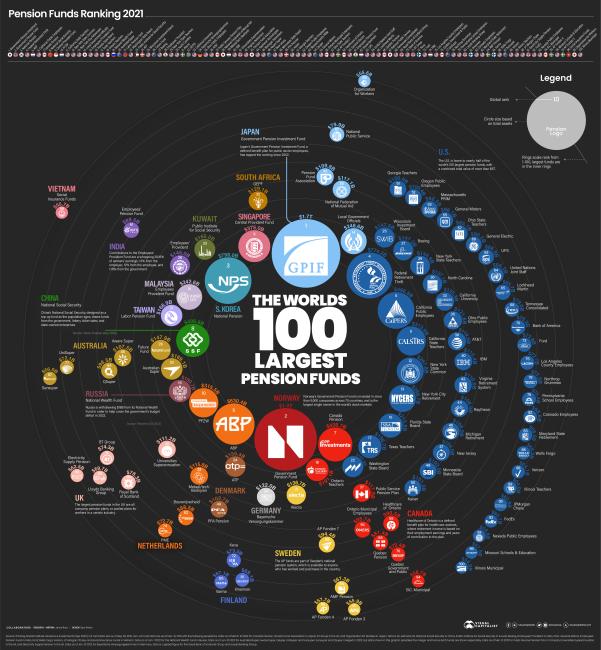

In stark contrast, pension funds and other asset owners have largely maintained their climate commitments. As universal long-term investors, they recognize that climate risk threatens their portfolio values more than ever. The conference highlighted that the fiduciary duty of public pension funds should compel them to consider systemic risks like climate change.

Systematic Pressure on Asset Managers

The retreat by asset managers must be understood in the context of systematic pressure from multiple directions:

- The SEC reintroduced guidance requiring ESG-related shareholder proposals to demonstrate company-specific financial materiality, making it easier for firms to exclude climate and social resolutions;

- The Department of Labor finalized rules prohibiting ESG considerations in retirement plans unless tied to strict financial returns;

- The SEC's reclassification of routine shareholder engagement as "activist behavior" triggered additional reporting burdens, leading some major firms to pause climate dialogues indefinitely;

- Over 25 states enacted laws penalizing financial institutions for "boycotting" fossil fuels;

- Legal intimidation campaigns coerced major law firms into providing USD 600m in pro-bono work that might be deployed against non-compliant asset managers.

Asset Owners Under Pressure: The Weaponization of Pension Funds

State pension funds in Republican-led states are increasingly being weaponized to advance political agendas at the expense of prudent risk management. Some state laws now mandate that pension funds divest from companies deemed to "boycott" fossil fuels, forcing fiduciaries to prioritize politically favored industries over financial stability. Similarly, other legislation compels pensions to invest in high-carbon emitters, even as studies show such mandates could result in significant divestment losses for retirement systems. Anti-ESG shareholder proposals amplify this pressure.

The politicization extends to broader regulatory and international contexts. While the U.S. government cannot (yet) directly mandate investment decisions of state pension funds, there have been legislative proposals aimed at discouraging ESG considerations through regulatory measures. Globally, funds could potentially face indirect pressures stemming from geopolitical tensions or trade-related factors, further complicating their ESG strategies.

This paradigm shift forces a reevaluation of asset owners' independence. Once seen as stewards of long-term value, pension funds from politically vulnerable countries might start to resemble sovereign wealth funds from countries where political objectives override fiduciary duty. As regulatory and geopolitical pressures mount, the line between principled stewardship and state-directed capital allocation grows increasingly blurred.

Rethinking Shareholder Power in a Polarized Environment

The conference raised important questions about the very nature of share ownership. The term "common ownership” does not accurately describe a situation where asset managers hold shares across industrial sectors but do not actually own them. Their recent actions are supposed to align with asset owners' preferences, suggesting "common stewardship" is more appropriate terminology. In light of the new reality, one might also opt for "common absence”.

This disconnect creates a crucial decision point for asset owners: Will they accept diminished stewardship from their asset managers, or will they take more direct action? Options include switching asset managers, taking over investment and stewardship functions themselves, or forming alliances with like-minded asset owners.

The Path Forward: Courage in a Time of Challenge

The conference proceedings suggest that shareholders play an even more important role in this disrupted landscape. While many asset managers face commercial and political pressures that may prevent them from fulfilling their responsibilities, this creates both a moral and commercial opportunity for truly committed shareholders to demonstrate leadership.

This evolving situation represents a "natural experiment" that scholars will study for years to come. What is clear is that despite increased difficulty, those who truly care about the future of their companies, beneficiaries, and our planet will need to step up with greater courage and commitment.

_______________

Marco Becht is a Professor of Finance and the Goldschmidt Professor of Corporate Governance at the Solvay Brussels School for Economics and Management, Université libre de Bruxelles, and a Founding Member, a Fellow, and the Executive Director of ECGI.

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.