The ECGI blog is kindly supported by

Board dynamics over the startup life cycle

Startups are often hailed for their contribution to innovation and creative destruction. One potential explanation for their contributions is their unique, dynamic governance structure. In our study, we provide a comprehensive analysis of startup board composition and dynamics.

The ownership structure of startups sets them apart from established public firms. Major shareholders in startups are typically a mix of entrepreneurs and venture capitalists (VCs), each with their own set of goals and both playing an active role in the management and operations of the business. Unlike publicly traded companies governed by many regulations, private firm boards operate in a somewhat uncharted territory. At one extreme, firms like FTX raised billions of external financing with a single board member, the founder-CEO. FTX’s board highlights the extreme flexibility of private board structures and shows we can learn much about startups from their board composition choices.

Typically, the composition of these boards and who holds control results from intense negotiations between VCs and entrepreneurs, with relative bargaining power being a critical factor. In scenarios where capital is abundant and thus entrepreneurs have strong bargaining power, boards tend to be under their control, with founders and executives of the startup occupying the majority of board seats.

However, board composition and who has control is far from static. As startups progress through their life cycle, the roles of major shareholders evolve, leading to a transformation in board composition. Changes in board control have many potential consequences for startup growth and success.

Shifting Control and the Role of Independent Directors

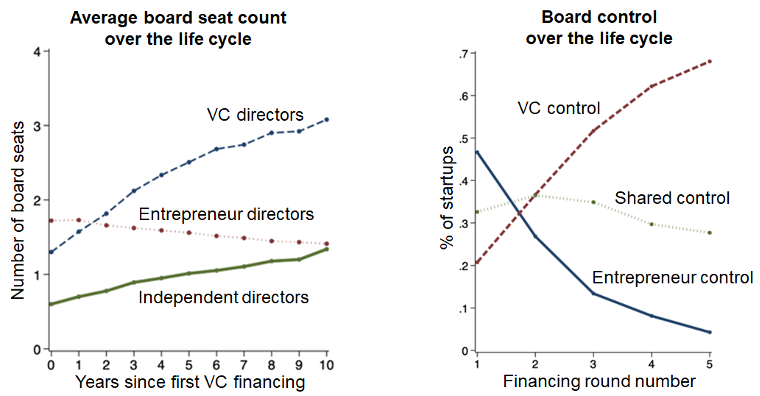

During the early stages, before the second VC financing round, entrepreneurs typically control startup boards, but over the life cycle, control shifts to VCs, with most board seats held by investors by the fourth round of financing. This transition isn't solely driven by ownership percentages; it also reflects the declining significance of the entrepreneur’s ideas and role as the startup matures and enters the product development phase.

Interestingly, independent directors – directors who are not affiliated with either entrepreneurs or investors and are mutually elected by the two parties – play an important role in this shift of control. Between entrepreneur control early on and investor control later, a typical board goes through the stage of shared control. This is when neither investors nor entrepreneurs control the majority of the seats, and independent directors effectively have a tie-breaking vote when the two parties disagree. The typical board structure in the second and third financing rounds is two investors, two entrepreneurs, and one independent director in a tie-breaking role.

The Unique Role of Independent Directors

The prevalence and voting power given to independent directors on startup boards is at first look quite puzzling. Their presence on the board is not mandated by law, and their traditional monitoring role, as seen in public firms, is not as critical. Instead of dispersed public shareholders, the shareholders of startups are large, sophisticated investors who play an active role in the firm’s operations and management and have ample ability and incentives to monitor the executives. So, why do we see so many independent directors having a tie-breaking vote?

Our analysis suggests that these directors act as mediators, resolving potential conflicts between VCs and entrepreneurs. Assigning a tie-breaking vote to independent directors serves as a commitment by both parties to maintain a fair playing field, even when disagreements arise. This commitment safeguards the interests of both parties and nurtures a mutually beneficial relationship.

We find that independent directors are less likely to have a tie-breaking vote when VCs and entrepreneurs have worked together in the past. Here, a repeated investment relationship is more likely when the VC and executives have shared views and trust each other, reducing the need for mediation. On the other hand, when VCs have a reputation for being heavy-handed in replacing startup executives, independent directors become a valuable resource for settling disputes over the company’s strategy and are more likely to join the board with a tie-breaking vote.

Evolution of Independent Directors’ Roles

But mediation isn’t the only role of independent directors. As startups mature and control leans more towards VCs, these directors often morph into advisors, aiding in the professionalization of the startup, particularly as investors prepare for an eventual exit. This changing role is reflected in the characteristics of independent directors over the startup’s life cycle.

Independent directors joining in the early stages are less likely to have interacted with either VCs or entrepreneurs in the past, consistent with the mediation role requiring them to be independent and impartial. Conversely, in later stages, independent directors tend to have stronger connections with VCs, more executive-level experience, and previous service on public boards.

In Conclusion

Overall, our results highlight unique features of startup governance. Independent directors’ roles as mediators and advisors are likely a critical component of how VC-backed startups navigate the complexity of risky, high-growth investments. The mediation role is likely to be especially important in the current environment, where capital is scarcer and VCs have more bargaining power. While in boom times, disagreements between investors and entrepreneurs are not very pronounced, such disagreements become especially relevant at times when valuations are low and VCs struggle to exit their investments to generate returns.

======

By Nadya Malenko, Professor of Finance at Boston College.

If you would like to read further articles on Private Equity and Venture Capital, click here

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.