The ECGI blog is kindly supported by

How Political Polarization Is Reshaping M&A in the U.S.?

A striking shift has taken place in the U.S. mergers and acquisitions (M&A) market over the past two decades. As political polarization has intensified nationally, firms with opposing political leanings have become markedly less likely to combine. This trend has implications not only for corporate strategy but also for how economic resources are allocated across the economy.

While much previous work has examined the causes of polarization, this study investigates its economic consequences. Specifically, it asks how political differences between a potential acquirer and target influence the formation and outcomes of mergers. The central hypothesis is that rising “affective polarization” — the tendency to distrust and dislike members of the opposing political party — creates integration frictions that discourage politically divergent firms from joining forces.

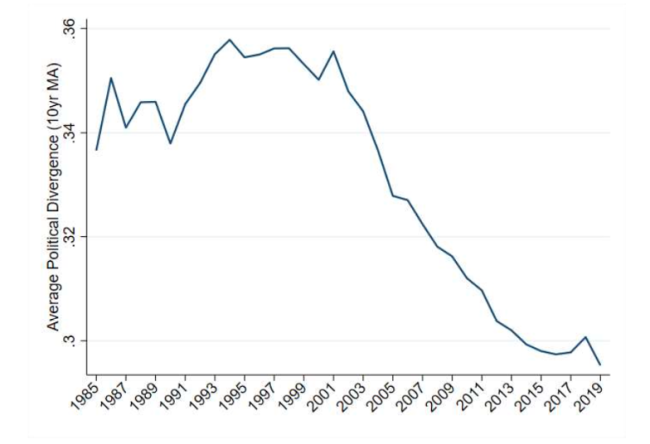

The researchers compiled a unique dataset linking U.S. public-company M&A deals announced between 1985 and 2019 to measures of the political leanings of each firm’s employees. Political affiliation was gauged using two sources: state voter registration records matched to LinkedIn employment histories, and personal political contributions recorded by the Federal Election Commission. A firm’s “Democratic Affiliation” reflects the share of employees who are registered Democrats or who donate to Democratic campaigns. The core measure, “Political Divergence,” captures the absolute difference between the acquirer’s and target’s Democratic Affiliation. The study examines aggregate trends and runs deal-level analyses using matched firm-pair models to estimate how divergence affects the probability of a merger.

The patterns are stark. Before 2010, mergers between the most politically different firms accounted for more than 11% of all deals; by 2019, they made up less than 3%. The average divergence between acquirers and targets declined by over a quarter between 1985 and 2019. The drop is visible not just in firm-level affiliations but also in geography: mergers between companies headquartered in politically different states have fallen sharply, from 18% of interstate deals before 2010 to under 10% afterward. These changes coincide with a sharp rise in the Partisan Conflict Index — a measure of political disagreement in U.S. media — beginning around 2010.

Across more than 2,200 mergers, the analysis finds that greater Political Divergence significantly reduces the likelihood of deal formation. A one standard deviation increase in divergence lowers the probability of an announced merger by 0.6 to 1.3 percentage points, or roughly 6%–15% relative to the mean likelihood. This effect holds after controlling for physical distance between headquarters, product market overlap, financial characteristics, corporate culture, and ESG differences. The deterrent effect of political divergence is concentrated in periods of high national polarization and in transactions where post-merger integration is a central objective. When integration is emphasized in SEC filings, the negative effect of divergence is roughly double that observed in deals without such emphasis.

The study points to integration costs as a key channel. Political divergence is more strongly associated with reduced deal likelihood when the divergence exists among rank-and-file employees rather than top management. This matters because the day-to-day integration of workforces can be more sensitive to interpersonal political divides than executive-level negotiations. Post-merger employment data from LinkedIn show that divergence predicts higher employee turnover in the year following a merger.

The results suggest that political polarization has real economic costs, influencing which mergers take place and which do not. In an era when many corporate combinations hinge on workforce integration, political compatibility has emerged as a nontrivial factor in partner selection. The decline in politically mixed mergers also points to a loss of potentially valuable combinations that could have reallocated assets more efficiently. From a corporate governance and policy perspective, these findings highlight how societal divisions can spill over into market transactions, affecting competition and the distribution of resources.

Political polarization is not just reshaping elections and public discourse — it is altering the map of corporate America. As trust across political lines erodes, the M&A market shows a growing preference for politically like-minded partners. This subtle but powerful force could continue to shape corporate strategy, asset allocation, and the structure of U.S. industry for years to come.

_________________

Ran Duchin is the Coughlin Family Professor of Finance in the Seidner Department of Finance at the Boston College Carroll School of Management.

Abed El Karim Farroukh is an Assistant Professor of Finance at the Kelley School of Business at Indiana University Indianapolis.

Jarrad Harford is the Paul Pigott - PACCAR Professor of Finance at the University of Washington’s Foster School of Business and an ECGI Research Member.

Tarun Patel is an assistant professor of finance at the Cox School of Business at Southern Methodist University.

This blog is based on a paper presented at the 3rd HKU Summer Finance Conference. Visit the event page to explore more conference-related blogs.

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.