The ECGI blog is kindly supported by

Does Sustainable Investment Inspire Sustainable Governance?

The global fixed-income market reached 140 trillion USD in 2024; from this, sustainable debt[1] is 5 trillion USD. Even though the latter is a small part of the global debt market, the growth in this sub-asset class is commendable as it originated post-financial crises. Most sustainable debt comes from corporations, and the rest comes from supranational agencies and other institutions.

Despite the tremendous spike in sustainable investment around the globe, limited disclosure on how the proceeds is allocated among the green projects and whether these projects help reduce negative environmental externalities raise concerns for investors. Also, green project categories are decided on green/sustainable bond principles, which are acceptable but are not mandatory guidelines for green project classification, and fear investors about greenwashing. Similar issues arise when implementing and managing green projects, which are supported by the proceeds of the sustainable debt. As firms want investors to support their green initiatives, they are adopting sustainable governance practices by hiring a chief sustainability officer (CSO) and forming an ESG/sustainability committee from existing board members or from external members who have expertise and experience in this field. For instance, a survey by Mattison Public Relations found that 54% of the Financial Times Stock Exchange (FTSE) 100 companies have a board-level committee dedicated to ESG issues. Such steps by firms are needed to communicate clearly with stakeholders about the firm's sustainable practices.

Our research investigates whether firms recognize the importance of sustainable governance and implement changes in their organizational structures to effectively leverage sustainable investments. To conduct this analysis, we collected data on 3,944 sustainable bonds issued by globally listed firms between 2013 and 2022 from the Bloomberg Global Fixed Income database. Approximately 77.5% of these bonds are classified as green bonds, while the remainder falls into categories such as sustainability bonds, sustainability-linked bonds, or similar classifications.

Data on sustainability governance metrics—such as the hiring of Chief Sustainability Officers (CSOs) and the establishment of Environmental, Social, and Governance (ESG) committees—were obtained from the BoardEx database. We aggregated these observations at the firm level, resulting in a final dataset that includes 6,925 firms and 59,019 firm-year observations. Of these, 30% (or 3,053 firms) have made significant organizational changes to enhance their sustainability efforts during the observed period. We measure sustainable investment by calculating the ratio of cumulative sustainable debt to the firm’s total debt, while we define sustainable governance using a binary variable that assigns a value of 1 to firms appointing a sustainability officer or establishing a sustainability committee within the year, and 0 otherwise. We externally validate these measures using different proxies of sustainable investment (such as natural logarithm of number of green debt) and sustainable governance.

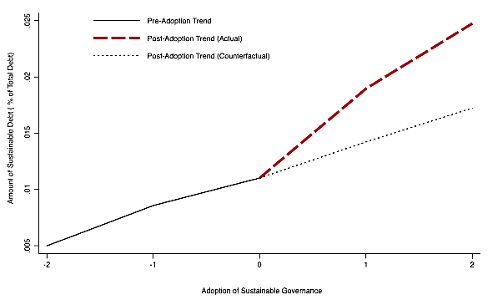

To conduct the empirical analysis, we begin with a panel regression that includes fixed effects for country, year, and industry. We find that a 1% increase in the amount of sustainable debt (in total debt issued) improves sustainable governance by 9 %. Results suggest that sustainable debt issuances inspire the firms to adopt sustainable governance. We are aware of endogeneity concerns, such as whether the adoption of sustainable governance increases sustainable investment or whether sustainable governance is a result of sustainable investment. To mitigate such concerns, we use identification through heteroskedasticity (see Rigobon (2003) and Rigobon and Sack (2003)) and generate the causal generalized method of moments (GMM) estimates. To show the robustness of our results, we conduct event studies. A figure, part of event study, demonstrates that how sustainable investment inspires the firms to introduce the organizational changes to better govern the investment and mitigate the concerns of investors regarding disclosures.

Further check reveals that this ‘investment inspires governance’ relation is slightly stronger among the financial institutions and in the countries which have strong investor protection laws. This result for financial institutions is appreciable as there are concerns about lack of due diligence by financial institutions on sustainable loan borrowers’ environmental performance.

Our findings suggest that sustainable investment encourages firms to implement sustainable governance practices. These initiatives can help companies monitor the progress of green projects, ensure successful implementation, manage proceeds from sustainable investments, and effectively communicate with investors about their green initiatives and sustainability efforts. This also supports the notion that whether the presence of better governance mitigate the concerns of investors even if disclosure is limited or opaque.

------------------------------

[1] Sustainable debt comprises green bonds, sustainability bonds, social bonds, and the sustainability-linked bonds. From these, the green bonds, sustainability bonds, and social comes with ‘use of proceeds’ restriction. It means issuers would invest the proceed amount only in project categories mentioned in green bond principles, sustainability bond principles, and social bond principles. In the sustainability-linked bonds, there is no restriction on the ‘use of proceeds’ but the issuer commit to curb environmental externalities otherwise there would be a penalty such as increase in the coupon rate.

_______________

By Jitendra Aswani (MIT Sloan)

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.