Compensate or abate?

Issue 10 | February 2024

Greetings from Brussels.

In the vast and ever-growing field of sustainability, carbon markets are an infamous regulatory rabbit hole. For this newsletter I decided that it was time for me to jump in, as I am curious about the role of corporations in carbon markets and their options when seeking to embrace responsible capitalism.

If you are equally curious, I invite you to join me and share your thoughts and expertise on the matter. Please forgive some over-simplifications in my attempt to grasp this wide topic in a few paragraphs.

Carbon markets briefly explained

Put simply, carbon markets are trading platforms on which carbon credits are exchanged. On the one hand there are public compliance markets, established through regional, national or international policies. One such example is when country A, failing to meet its targets set under the Paris Agreement, can buy additional carbon credits from country B.

Next to this system is the voluntary market, where private entities develop projects targeting emission reductions or carbon removal, in order to sell carbon credits. Individuals or companies can purchase such credit certificates and thereby ‘compensate’ or ‘offset’ the negative environmental impact they made by taking a flight, for example. Voluntary markets are supposed to be additional, meaning the project provides a climate benefit that goes beyond what has already been agreed to elsewhere.

There are many things to criticize about this voluntary market, ranging from false and inflated emission reduction or carbon removal claims, poor monitoring of the projects, human rights issues and greenwashing claims, as companies misrepresent themselves or their products as climate-neutral.

Double-counting

Another problem, present in both voluntary and compliance markets, which I want to highlight, is double-counting, or more precisely, double-claiming. It occurs when the positive climate impact is claimed by several entities, either by two countries or by both a country and a business.

The first happens when country A sells its credit from a carbon capture project to country B. Country B can then use this credit to reach its own targets under the Paris Agreement. Country A can no longer claim this positive impact to meet its own targets, as such double-counting is by now widely considered as unacceptable and accounted for in Article 6(2) of the Paris Agreement.

It gets more controversial where the voluntary and compliance markets overlap.

If a carbon removal project is set up in country A and the corresponding carbon certificate sold to company C in a different country, can both company C and country A claim the same removed emissions?

Some may argue yes, as they play out on two different levels, given that company C is not subject to any obligations under the Paris Agreement. In light of how much funding is necessary to finance all these carbon removal or carbon capture and storage projects, shouldn’t we welcome it if companies want to help finance them, and isn’t it understandable that in turn they want to be able to claim some of the positive benefits? If not by claiming to compensate their own activities, then at least by publicizing that the company made a financial contribution towards country A’s targets?

Let’s look at the other perspective. The country A in which the project takes place already committed to its targets and has to undertake this project to reach its own carbon reduction and removal goals, regardless of whether company C pays for it or not. Company C therefore did not contribute to anything that would not have already happened otherwise. Instead, company C might feel discouraged to cut its own emissions, as compensating them this way seems far easier. Or, looking at it from the country’s perspective, wouldn’t it lose its drive to finance emission reductions if it can just wait for a company to cover the cost? By allowing both the country and the company to claim the same carbon credit, don’t we undermine the additionality aspect of the voluntary markets?

And by scaling up this global carbon removal market, do we direct attention away from the most pressing issue, which is to actually cut emissions?

As you can tell, I have more questions than answers at this point and I am sure there are many other elements to consider. Before I leave you to further dwell on this topic, I’d like to draw your attention to the soon to be adopted EU carbon removal certification framework , which certifies carbon removal projects taking place in Europe. Its position on double-counting is rather vague and it seems that the EU plans to count all the issued certificates towards reaching its targets under the Paris Agreement, but also opens up the possibility for companies to purchase and use them towards their own climate goals.

I am curious to hear your thoughts on this matter, so please let me know in the poll below.

Cordially yours,

Marleen

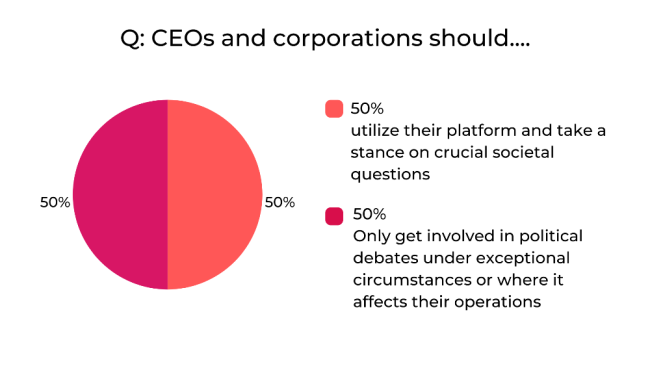

MINI POLL

MORE FROM ECGI...

PREVIOUS ISSUES...

In Focus Newsletter

Issue #9 - CEO Activism (January 2024)

Issue #8 - Does it (still) pay off to pollute? (November 2023)

Issue #7 - Mind the Gender (Eco) Pay Gap (October 2023)

Issue #6 - KPop or Meme Stock (September 2023)

Issue #5 - Exit or Voice? Time to take stock (June 2023)

Issue #4 - Controlling Shareholders (May 2023)

Issue #3 - Practicing Systematic Stewardship (April 2023)

Issue #2 - The Who, What and Why of ESG (March 2023)

Issue #1 - Responsible Capitalism (February 2023)

Marleen Och is a PhD researcher at KU Leuven, Belgium.

She works in the field of sustainable finance and corporate governance, writing about shareholder engagement and sustainability.

Please feel free to get in touch, share your thoughts and let us know how we're doing, email Marleen.Och@ecgi.org and follow us on Twitter at @ecgiorg