The ECGI blog is kindly supported by

What might disclosure rules reveal about corporate carbon damages?

Greenhouse gas emissions inflict significant costs on society, but mandatory disclosure of corporate emissions would provide the data necessary for efficient climate policies and market signals, as well as possibly cause firms to voluntarily reduce their emissions in response to the public disclosure.

In 2022, the U.S. Securities and Exchange Commission (SEC) proposed a rule that would mandate that public companies report their greenhouse gas (GHG) emissions. This follows similar efforts in the European Union and United Kingdom, where regulations require companies to report both the impacts of their activities on people and the environment as well as how various sustainability elements affect the company. Widespread mandatory disclosure can be the sunshine that facilitates progress on climate change. Provided a mandate produces reliable measurements of GHG emissions, disclosure would allow financial markets to better price emissions, as well as provide a foundation for policies to restrict emissions. Mandating disclosure would also provide information on material risks to investors, making it evident which firms are most exposed to future climate policies. Additionally, emissions reporting has the potential to galvanize pressure from companies’ key stakeholders (e.g., customers and employees), leading firms to voluntarily reduce their emissions. What might such disclosure reveal? Our study introduces the concept of “corporate carbon damages,” a measure of the total costs to society.

Research Design

The analysis uses one of the largest global data sets on reported and estimated corporate GHG emissions, covering roughly 15,000 publicly traded firms. The vast majority of these emissions are estimated by S&P Trucost because companies do not report emissions. Moreover, a major challenge is that even for the companies that do report their emissions, they rarely provide third-party validation and there are no penalties for false reporting, underscoring the need for mandatory disclosure. For each firm, “corporate carbon damages” are calculated as the product of their Scope 1 CO2 equivalent emissions and the social cost of carbon (SCC)—the monetary value of the damages associated with the release of an additional ton of CO2. To account for differences in firm size and facilitate comparisons across firms, the authors then divide the (absolute) climate damages by the respective firm’s operating profit or sales to develop their measures of corporate carbon damages.

Findings

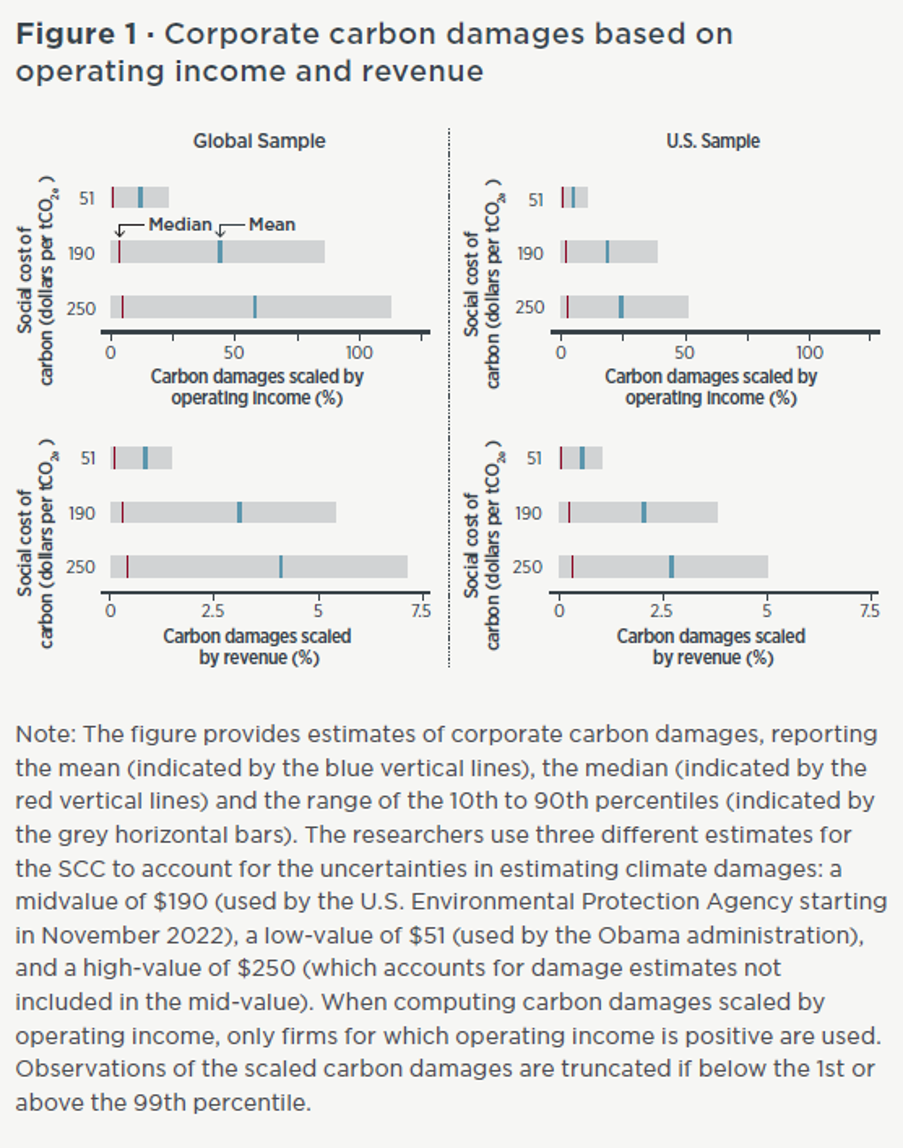

On average, corporate carbon damages are large, but there is substantial variation across firms. Globally, corporate carbon damages equal roughly 44 percent of firms’ operating profits and 3.1 percent of their revenues (using a SCC of $190). Average damages from U.S. firms equal 18.5 percent of their profits and 2 percent of their revenues. However, the averages are skewed by firms with outsized carbon damages and there are many firms with much lower damages in the middle of the distribution. Figure 1 illustrates that there is substantial variation, with firms on both ends of the spectrum—those with minimal carbon damages, and those with outsized damages.

Corporate carbon damages vary widely across and, more notably, within industries. As one would expect, the largest carbon damages stem from energy-intensive industries such as utilities, materials, energy, transportation, and food, beverage, and tobacco. The average damages for this subset are well above the average for all firms studied. It is noteworthy that the four industries that contribute the highest damages—utilities, materials, energy and transportation—account for 89 percent of the total global corporate carbon damages. Perhaps more surprising, there is substantial variation in corporate carbon damages among firms within the same industry. For example, even in a relatively homogeneous industry like diesel-powered rail transportation, there is substantial variation. For firms with high carbon damages (90th percentile) within the industry, the damages are equal to 31 percent of their profits, but only equal to 14.7 percent of profits for those that contribute a small amount of damages (10th percentile).

Mandatory disclosure and peer benchmarking has the potential to reduce carbon emissions. The significant heterogeneity in corporate carbon damages within industries suggests that mandatory disclosure could lead heavily polluting firms to reduce emissions due to pressure from key stakeholders within or outside the firms. In fact, the researchers estimate what would happen if all firms with carbon damages per dollar of profit above their industry’s median reduced their carbon damages to their respective industry median. They find that this would reduce total direct emissions by 70 percent.

Corporate climate damages vary widely from country to country. The countries with the highest average carbon damages as a percentage of firms’ profits are Russia (129.6 percent), Indonesia (89.6 percent), and India (78.8 percent). The countries with the lowest are the United Kingdom (21.7 percent), United States (25.7 percent), and France (29.5 percent).

Mandatory emissions disclosure would give firms incentives to think strategically about their GHG emissions. It additionally has the potential to cause peer benchmarking that leads to emissions reductions due to pressure from stakeholders inside and outside the firms. Such transparency would also provide the data necessary for designing and enforcing many climate policies.

-----------------------------------------------------------------------------------

By Michael Greenstone, the Milton Friedman Distinguished Service Professor in Economics as well as the Director of the Becker Friedman Institute and the interdisciplinary Energy Policy Institute at the University of Chicago, Christian Leuz, the Charles F. Pohl Professor of Accounting and Finance at the University of Chicago's Booth School of Business, and Patricia Breuer, the Chair of Business Administration and Accounting at the University of Mannheim.

This article was originally published as a research highlight on EPIC and the research study is published by Science Journal.

If you would like to read further articles in the Governance & Climate Change series, click here

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.