The ECGI blog is kindly supported by

Colombian Benefit Corporations in Perspective

Colombian Company Law has been at the forefront of Latin American systems for the last few decades. In 2008, it was the first country in the region to adopt a hybrid company form, by introducing the Simplified Corporation (SC). This business entity, which was inspired by the American closely held corporation and the French Société par Actions Simplifiée (SAS), was so successful that in 2017 it led to the adoption by the Organization of American States of the Model Law on Simplified Corporations. Such an auspicious beginning paved the way to the Argentine law on the SC of 2017, the Uruguayan SC of 2019 and the Ecuadorian SC of 2020. These laws are the direct heirs of the Colombian initiative for the SC. The Colombian legal system triggered a harmonization of Company Law in the South American region for the first time.

The Colombian legislature has also been a pioneer in the enactment of norms related to Benefit Corporations (referred under the law to as BIC Companies). These types of hybrid business entities were introduced by Law 1901 of June 18, 2018. Before this legislation the local legal system had zealously defended the shareholder wealth maximization principle. The possibilities of investing resources in non-profit activities were subject to significant legal restrictions, as developed by doctrine and case law.

Colombian legislation on BIC companies adopts simple criteria, devoid of formalities for the adoption of this type of business.

Colombian legislation on BIC companies adopts simple criteria, devoid of formalities for the adoption of this type of business. The laconic nature of Law 1901 of 2018 (only 10 articles), makes it relatively easy to apply. Moreover, the obligations that arise for shareholders, officers and directors do not represent significant transaction costs.

The law defines a Commercial Benefit and Collective Interest company as “those companies that are registered in accordance with the current legislation, which, in addition to the benefit and interest of their shareholders, will act in the interest of the community and the environment.” This provision highlights the hybrid nature of this type of entity. Whereas in traditional commercial companies, charitable activities are only viable to the extent that there is a determinable relationship with the corporate purpose, in BIC enterprises there is considerable leeway to carry out activities aimed at the common benefit.

After the issuance of the Colombian Law on Benefit and Collective Interest Companies, there are no obstacles for a commercial B company to carry out non-profit activities.

After the issuance of the Colombian Law on Benefit and Collective Interest Companies, there are no obstacles for a commercial B company to carry out non-profit activities. An affinity between the purpose clause and the company’s business activities is no longer needed once the shareholders adopt a BIC company status. Therefore, it is not necessary to demonstrate a connection with the economic operations in which the company is engaged, in order to undertake non for-profit activities. Nor is it essential that there be a criterion of proportionality between what is spent on activities of collective interest and the economic benefits that the company obtains for carrying out such activities. For example, a BIC company could validly allocate 80% of its resources to investments that have a beneficial impact on the environment and only 20% to commercial acts from which the company derives economic benefits for its shareholders. In this example, the charitable activities could not be considered ultra vires and, therefore, their invalidity would not be actionable due to the company’s lack of capacity to carry them out.

Based on the developments that have been outlined, it can be argued that the very definition of the company achieves a wider scope, by facilitating the allocation of its resources, at least partially, to activities that may have a beneficial social impact. Therefore, BIC companies are expected to contribute to the promotion of responsible capitalism in Colombia. This concept makes it possible to overcome the narrow space delimited by the principle of maximizing the interests of shareholders, to achieve a wider scope. That is why the bylaws of BIC companies allow for decisions that cover the interests of third parties (stakeholders) to be included in the company's plans, in addition to those that are inherent to the partners or shareholders. In fact, corporate directors are required to ‘take into account the interest of the corporation, its shareholders, and the collective interests [of a variety of stakeholders] mentioned in the company’s articles of association”. Thus, for example, corporate decisions that grant benefits to workers, pensioners, consumers, suppliers and, in general, members of the communities where the company operates can be validly adopted even if these decisions are not in the best interests of the shareholders.

Colombian legislation has adopted a highly flexible model of a benefit and collective interest company that does not represent high transaction costs for those entrepreneurs who wish to adopt it.

Colombian legislation has adopted a highly flexible model of a benefit and collective interest company that does not represent high transaction costs for those entrepreneurs who wish to adopt it. The fact that it is not a specific type of company (requiring conversion to take advantage of its features) undoubtedly facilitates the adoption of these hybrid business modalities.

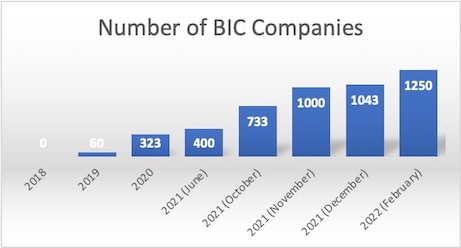

That is probably the reason why, the model of BIC companies has been so successful in Colombia. As can be verified from the statistical data provided in the chart below, the growth of this business model has been exponential within the last few years.

Source: Colombian Superintendence of Companies (2022)

The evident benefit that arises from BIC companies consists of the possibility of acting legitimately in lucrative and non-profit spheres. Before the advent of this legislation, the activities of benefit and collective interest were not legally viable, due to the restrictions derived from the essential element of profit sharing, the ultra vires doctrine, and the more limited scope of directors’ duties. Certainly, the principle that governs the Commercial Code and other complementary regulations is that of maximizing the economic benefits of the shareholders.

========================================================================

Francisco Reyes Villamizar is the Former Chairman of the United Nations Commission for International Trade Law (UNCITRAL) (for the period 2015-2016), Colombian Superintendent of Companies (and Bankruptcy) (October 2014 to November 2018), and Member of the Academy of Comparative Law and the Colombian Academy of Jurisprudence.

This article is from the special issue of the ECGI Blog on Corporate Governance in Latin America including articles from Marta Viegas & Aurelio Gurrea-Martinez.

This article reflects solely the views and opinions of the author(s). The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.