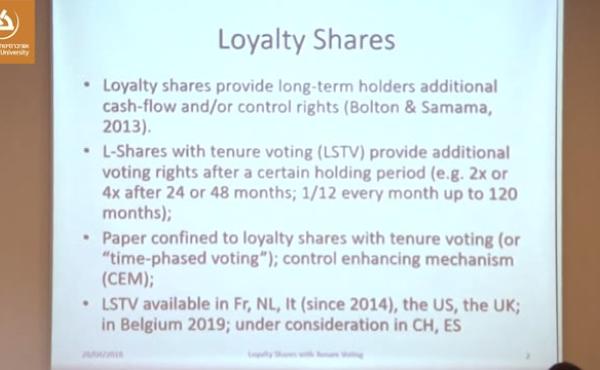

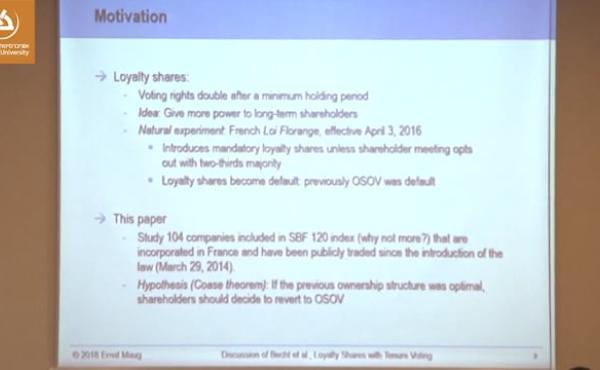

Loyalty Shares with Tenure Voting - Does the Default Rule Matter? Evidence from the Loi Florange Experiment

Abstract

The contractual theory of the firm predicts that companies adopt charters that maximise firm value, regardless of the default rule. We test this proposition around an exogenous switch of the default from one share-one vote to tenure voting following a law reform in France. In initial public offerings (IPOs) tenure voting is primarily adopted by families and after the reform its use increases slightly but not significantly. The change in default rule has no significant impact on company characteristics or valuations. For companies that were already listed with one share-one vote and would have been forced to switch to tenure voting by default we observe a revealed preference for the choice they had made at the IPO; one share-one vote companies preserve their pre-reform status, unless the French state has a blocking minority. Overall, the results suggest that once firms have optimized, changing the default rule imposes transaction costs without changing outcomes.