The ECGI blog is kindly supported by

Understanding the relationship between corporate purpose and profits.

Nowadays, it seems every company claims to have some higher "purpose" beyond profits. Given that these companies are also for-profit entities, proponents claim that higher purposes invariably lead to higher profits. In the words of Blackrock CEO, Larry Fink, “Purpose is not the sole pursuit of profits, but the animating force for achieving them. Profits are in no way inconsistent with purpose--in fact, profits and purpose are inextricably linked.”

Skeptics disagree. They dismiss purpose as empty sloganeering designed to confuse shareholders and shield poor performance. Pursuing purpose may be admirable but ultimately distracts from the business of running a business.

Which view is correct? Does pursuing purpose actually boost profits or is there a trade-off between the two? These questions get to the heart of the vigorous and important debate about the role of business in society. New research sheds light on a potential answer.

The biggest challenge in empirical research on corporate purpose is how to measure it. Purpose is, by nature, intangible. This intangibility means that it is impossible to observe directly and instead can only be measured by proxy. So what proxy to use? Rather than relying on CEO statements and corporate filings that have been critiqued as cheap talk, we have developed a measure based on the aggregated beliefs of employees themselves. We consider these beliefs as a credible signal of purpose: if employees believe that their work has meaning, then there is something the organization is doing to instill that sense of purpose, even when we cannot observe it. Importantly, our survey data also allows us to measure this sense of purpose independently from other sentiments, including overall job satisfaction and trust in management.

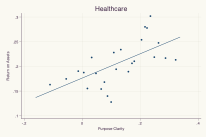

Using this measure, we find the purpose-profit connection varies dramatically by company and sector. In some industries like healthcare, purpose and profits are mutually reinforcing – stronger purpose corresponds to stronger financial performance. But in others like financial services, we see a trade-off - more purpose translates to less profit.

What explains this pattern? The research points to two key factors

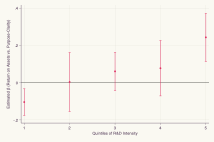

The first is how much a company relies on innovation and intangible assets like intellectual property, brands, and capabilities. In high intangibles settings, purpose may be vital for motivating creativity and teamwork that formal incentives do not elicit. Purpose provides inspiration and direction that enable companies to outperform. In low intangibles settings – for example, those companies reporting zero R&D expenses – we find the opposite pattern. Stronger purpose corresponds to lower profits. Those settings may be relatively more focused on cost-savings and efficiency as the basis of profitability, and a strong purpose may indeed be challenging to pursue alongside those goals.

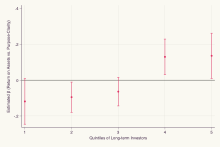

The second is the temporal horizon of the company’s owners. Companies owned by patient investors exhibit a positive link between purpose and long-run profits. Those owned by short-term investors show the opposite pattern - purpose detracts from near-term earnings. This divergence suggests that patient owners may be better positioned to realize the long-term value that can arise from purpose, whereas short-term owners prioritize immediate results which purpose may hamper. Short-term owners may also apply greater pressure on executives to deliver immediate returns, which could come at the expense of purpose-driven decisions that pay off over longer periods.

So what does this teach us? Several insights emerge:

First, purpose and profits do appear to coexist and reinforce each other, but only under certain conditions - when innovation and intangibles drive value creation and owners take a long-view.

Second, we cannot assume this positive purpose-profit relationship holds everywhere. Trade-offs exist. In settings with inherent trade-offs, mandating purpose may prove an ineffective tool for achieving social objectives via for-profit entities. Different approaches are likely needed.

Lastly, two sweeping trends appear to be colliding with unpredictable consequences. First, the economy is shifting more toward innovation and intangible assets as the basis of production, conditions that are consistent with purposeful companies flourishing financially. Second, the nature of capital markets is shifting, with many signs pointing toward shorter-horizoned and more engaged owners. How these two shifts combine to support or detract from purpose-aligned strategies remain unclear.

In the end, this study counters the sweeping generalizations of the current debate. The findings reveal that purpose can lead to stronger financial performance given the right conditions - when innovation and intangibles form the basis of value creation and owners take a long-term view. The implications are clear: we should be realistic about where tradeoffs exist, while also encouraging settings in which purposeful, profitable businesses can flourish.

======

By Claudine Gartenburg, an Assistant Professor of Management at the Wharton School of the University of Pennsylvania.

If you would like to read further articles on Corporate Purpose, click here

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.