The ECGI blog is kindly supported by

Do investors care about biodiversity?

The Biodiversity Challenge

Biodiversity, the variety of living organisms in all habitats, is deteriorating at an unprecedented and alarming level. Global biodiversity collapse jeopardizes the goods and services humans obtain from ecosystems to ensure their well-being, including food, air and water quality, and landscape, with potentially far-reaching economic implications. In addition, biodiversity loss may bring about a new “era of pandemics.”

While the UN Convention on Biological Diversity (CBD) entered into force in 1993 and several Conferences of the Parties (COPs) to the CBD have adopted various plans to protect biodiversity, most goals have not been achieved; notably, the US has signed but not ratified the CBD. Recent globally coordinated steps toward protecting biodiversity include the Kunming Declaration of 2021, the Montreal Agreement of 2022, and the High Seas Treaty of 2023.

Given the potentially dramatic financial consequences of the loss of biodiversity, central banks and financial market supervisors are increasingly paying attention to the topic. However, it is striking that the link between biodiversity and finance has received very little attention by academic researchers. As a result, important issues such as the risks related to biodiversity loss, how those risks are priced, or how financing flows need to be shifted toward biodiversity conservation remain underexplored.

In a new paper, Alexandre Garel, Arthur Romec, Alexander Wagner, and I take a first step toward filling this gap by introducing to the finance literature a new proprietary measure, the Corporate Biodiversity Footprint (CBF), and exploring whether investors price the biodiversity harm caused by firms.

New Biodiversity Measure

Our measure is developed by Iceberg Data Lab and reflects the extent to which ecosystems affected by the business operations of a firm have been degraded from their pristine natural state. To this end, the CBF metric aggregates the biodiversity loss caused by a firm's relevant annual activities and expresses this loss in terms of km²MSA (Mean Species Abundance). A CBF score of 100km²MSA corresponds to either the loss of all the original biodiversity over an area of 100km², or a reduction of 10% over 1,000km². The measure quantifies a firm’s direct and indirect impacts on biodiversity from four sources: land use, greenhouse gas emissions, water pollution, and air pollution. On average, land use represents the source of environmental pressure with the greatest impact on biodiversity.

Our analysis focuses on cross-sectional regression models relating the stock returns of individual firms to their biodiversity footprints. Our global sample consists of data on 2,092 listed firms from 35 countries between 2019 and 2021. This sample represents the universe of public firms for which data on biodiversity footprints are available from Iceberg Data Lab over 2018-2020. While our sample period includes only a few years, the most important policy developments concerning biodiversity are also quite recent.

Anatomy of the Corporate Biodiversity Footprint

Before considering stock returns, we analyze the determinants of a firm's biodiversity footprint. We find that it increases with firm size. Unsurprisingly, it relates positively to a firm's carbon emissions, which represent one source of environmental pressure through which firms harm biodiversity. The biodiversity footprint also correlates positively with the environmental (E) score of Refinitiv, one of the leading vendors of ESG data (i.e., firms with a larger biodiversity footprint tend to have better E scores). To the extent firms with a higher biodiversity footprint face a stronger demand from investors and society to report on their potential impact on the environment, one could expect such a correlation. Finally, we demonstrate that country and industry fixed effects capture the substantial variation in biodiversity harm across firms. Firms from Finland, Brazil, and Germany, and in the Retail and Wholesale, Paper and Forest, and Food sectors, record the highest average biodiversity footprints.

Cross-Section of Stock Returns and Biodiversity

Turning to the returns analysis, our first result is that no robust evidence exists that the biodiversity footprint is priced in the cross-section of returns. This result is inconsistent with investors either having preferences for stocks with a lower impact on biodiversity or requiring higher returns for the regulatory and reputational risks associated with a higher impact. When we consider different countries, world regions, and industries, we continue to find no evidence of a link between biodiversity footprints and the cross-section of returns in any of these sample subsets.

Biodiversity Policy Shocks and Stock Returns

Our second result exploits the pricing impact of two recent biodiversity policy shocks that, plausibly, increased both investor awareness about the loss of biodiversity and the prospect of future regulations to preserve biodiversity. These events are the declarations adopted during the two parts of the UN Biodiversity Conference (COP15), which took place in October 2021 (Kunming) and December 2022 (Montreal). The Kunming Declaration calls for countries to act urgently to protect biodiversity through their decision-making and to recognize the importance of conservation in protecting human health. Analogous to the Paris Agreement for climate change, the Kunming Declaration stresses the need to align financial flows to support the conservation and sustainable use of biodiversity (Article 13). The second part of the COP15, in Montreal, ended with a landmark agreement including 23 targets for achievement by 2030. The most prominent one, known as 30×30, places at least 30% of the world's land and ocean areas under protection. Another target adopted in the Montreal Agreement is to “require large and transnational companies and financial institutions to monitor, assess, and transparently disclose their risks, dependencies, and impacts on biodiversity through their operations, supply and value chains, and portfolios.” Because the outcomes of the two parts of COP15 were not determined beforehand, they qualify as plausible shocks to investors' expectations regarding the transition and regulatory risks faced by firms with large biodiversity footprints.

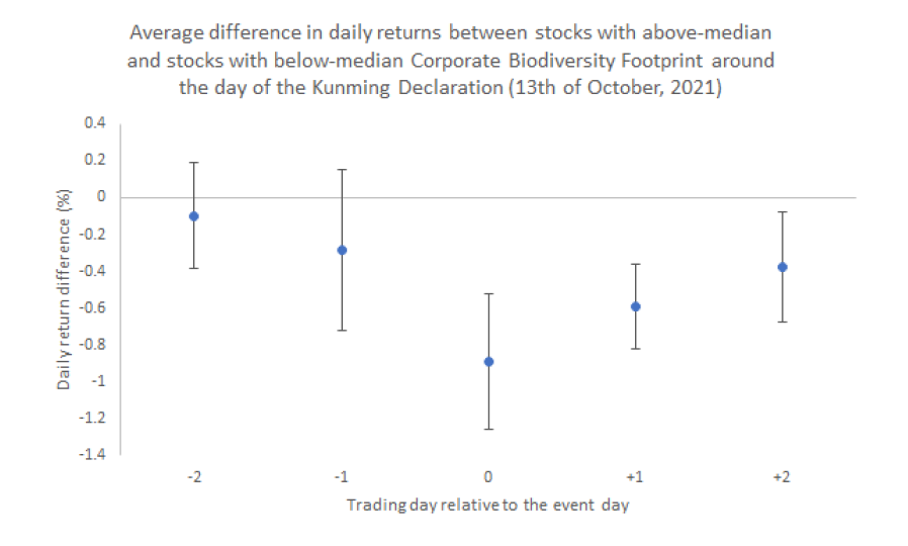

If the COP15 raised their awareness of biodiversity issues and the prospect of future regulations aimed at preserving it, we would expect investors to revise downward their valuation of firms with larger biodiversity footprints. Indeed, we find that, in the three days following the announcement of the Kunming Declaration, relative to the three days before, large-CBF stocks experienced a stock price reaction of about -0.5 %, significant at the 1% level, relative to small-CBF stocks. This result is illustrated in the figure below.

For the second part of the COP15 (Montreal), we do not detect negative stock price reactions, on average, for large-CBF firms. However, we find economically important heterogeneity in the market reaction when we condition the analysis on country-level measures of biodiversity protection. Notably, we find a significant negative stock price reaction to the Montreal Agreement for firms located in countries with low levels of protection for biodiversity. The effects are particularly strong for firms with a large biodiversity footprint related to land use, which is plausible, given that the Montreal Agreement's 30×30 target is most relevant for firms with large land-use related biodiversity impacts.

Overall, we conclude that the biodiversity footprint has not, on average, affected stock returns in recent years, but that it is beginning to be priced by investors. Specifically, we show that two recent events likely to raise investors' awareness of the prospect of regulatory interventions to preserve biodiversity are associated with changes in the valuation of large-CBF stocks.

--------------------------------------------------------------------------------------------------------

By Zacharias Sautner, Frankfurt School of Finance & Management and ECGI Research Member.

To read further articles on Biodiversity, click here

If you would like to read further articles in the 'Governance and Climate Change' series, click here

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.