Fifth Annual Mergers and Acquisitions Research Centre Conference

Fifth Annual Mergers and Acquisitions Research Centre Conference

Monday, 28 June 2021 | 12:00 – 16:00 BST (13:00 – 17:00 CEST)

Tuesday, 29 June 2021 | 12:00 – 16:00 BST (13:00 – 17:00 CEST)

Organised by

Scott Moeller (M&A Research Centre, City, University of London)

Anh Tran (City, University of London)

Paolo Volpin (City, University of London and ECGI)

Since 2016, the annual MARC conference has brought together cutting-edge research and practice on M&A by leading professors and industry experts around the world. Topics span a broad array of issues related to M&A such as deal structure from financing to integration, activism, regulatory changes, domestic and cross border transactions and corporate social responsibility among others. The conference was held in cooperation with the European Corporate Governance Institute (ECGI). We are honoured to have many world-leading academic experts in the field of M&A serving in our programme committee.

The MARC conference is among the most selective high-quality conferences in the field. The papers presented at the conference are at the forefront of knowledge and of high academic rigour, as evidenced by a high acceptance rate in the top three academic journals in accounting and finance. As of January 2021, four out of eight papers presented at the first conference in 2016 have been published in the Journal of Finance and the Review of Financial Studies. Four out of seven papers presented at the second conference in 2017 have been published in the Journal of Financial Economics, the Review of Financial Studies, and the Journal of Accounting Research.

Programme

Welcome and Introduction

Speaker(s)

Session 1: Chaired by

Speaker(s)

Hiring high-skilled labor through mergers and acquisitions

Speaker(s)

Discussant

Security design for the acquisition of private firms

Speaker(s)

Discussant

Break

Session 2: Chaired by

Speaker(s)

Acquisitions and CEO compensation changes

Speaker(s)

Discussant

Closing Remarks

Speaker(s)

Welcome and Introduction

Speaker(s)

Session 3: Chaired by

Speaker(s)

EPS-Sensitivity and Mergers

Speaker(s)

Discussant

Break

Session 4: Chaired by

Speaker(s)

How do equity analysts impact takeovers?

Speaker(s)

Discussant

Closing Remarks

Speaker(s)

Speakers

Fangyuan Ma

Thomas Noe

Paolo Volpin

Anjana Rajamani

Tingting Liu

Vicente Cuñat

Ulf Axelson

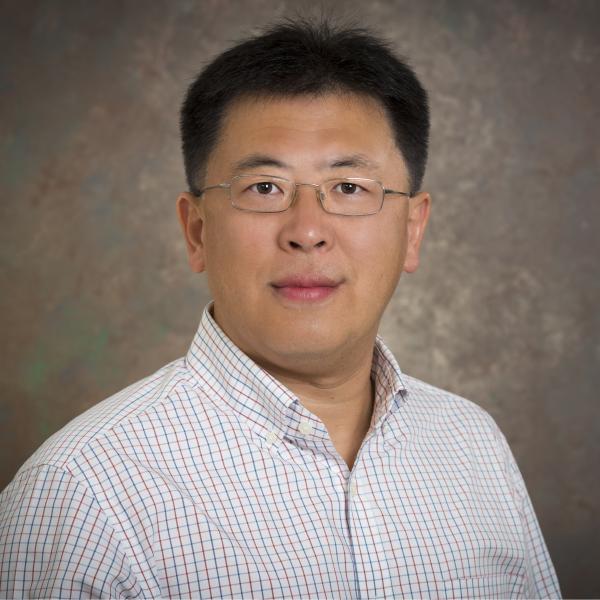

Fei Xie

Merih Sevilir

Presentations

Contact