Finance Series

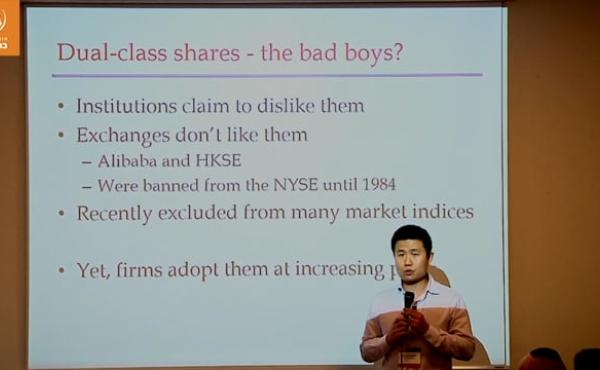

Sticking around Too Long? Dynamics of the Benefits of Dual-Class Voting

Abstract

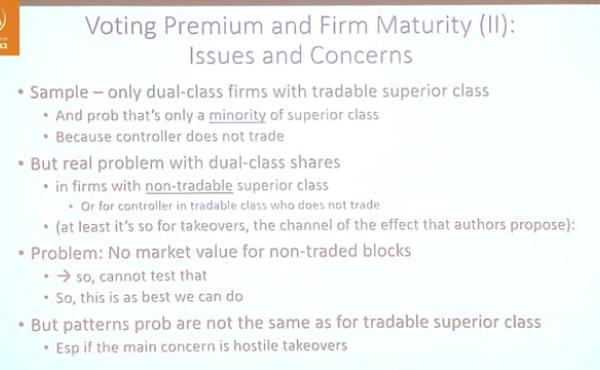

Using a new dataset of corporate voting-rights from 1971 to 2015, we find that young dual-class firms trade at a premium and operate at least as efficiently as young single-class firms. As dualclass firms mature, their valuation declines, and they become less efficient in their margins, innovation, and labor productivity compared to their single-class counterparts. Voting premiums increase with firm age, suggesting that private benefits increase over maturity. Most sunset provisions that dual-class firms adopt are ineffective. Our findings suggest that effective, timeconsistent sunset provisions would be based on age or on inferior shareholders’ periodic right to eliminate dual-class voting.