Banca Generali S.p.A.

Institutional Member

Contact Information

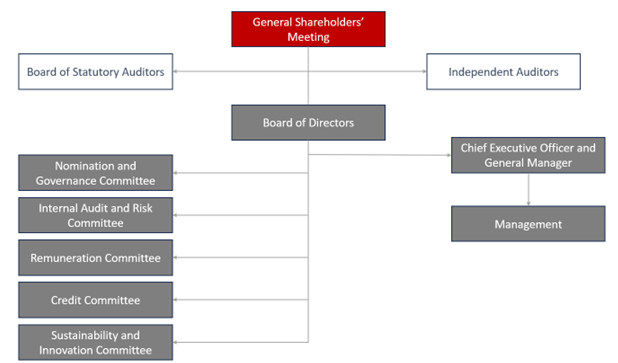

CORPORATE GOVERNANCE SYSTEM

For a constant, solid and sustainable growth.

Organizational Structure

Banca Generali’s overall corporate governance framework was defined in line with the current laws and regulations, also taking into account the recommendations of the Corporate Governance Code, that Banca Generali S.p.A. complies with, the principles enshrined in the best practices (including international ones), as well as the Bank of Italy’s Supervisory Regulations and, with particular reference to corporate governance issues, to the Regulations for the Prudential Supervision of Banks issued by the Bank of Italy with Circular No. 285.

Banca Generali S.p.A.’s corporate governance structure is based on the Italian traditional model, which consists of the following corporate bodies: a Board of Directors (composed of 9 members, 4 women and 5 men, including the Chairman and the CEO), within which there are 5 Internal Board Committees (Nomination and Governance Committee; Internal Audit and Risk Committee; Remuneration Committee; Credit Committee; Sustainability and Innovation Committee), a Board of Statutory Auditors and the General Shareholders’ Meeting.

Through the Regulation of the Board of Directors and Internal Board Committees, sustainability aspects and principles have been included in the Managerial Steering Committee and in the specific competence areas of all Internal Board Committees. The General Counsel & Sustainability Area, where the sustainability-related competencies have converged since 2018, takes forward its guiding role, as a key element connecting the different internal Structures.

Board of Directors

The Board of Directors (BoD) leads the Company pursuing its sustainable success, which consists in creating long-term value for the benefit of Shareholders, taking into account the interests of other stakeholders relevant to the Company, formulating consistent strategies for the Bank accordingly and verifying and monitoring the implementation on an ongoing basis.

Banca Generali recognizes and reaps the benefits of diversity at the level of the Group, its Corporate Bodies and its management, in all respects, including gender, age, qualification, competencies, training and professional background. To this end, Banca Generali’s Board of Directors have approved the Diversity Policy for Members of Company Bodies that formally establishes the criteria and tools adopted by the Bank to ensure an adequate level of diversity and inclusion within its Corporate Bodies.

The provisions contained herein are drawn up in accordance with the Diversity Policy adopted by the Generali Group and in compliance with applicable legislation, the Articles of Association and internal regulations.

ANNUAL INTEGRATED REPORT

With over twelve years of non-financial reporting, since 2018 we present non-financial information within the consolidated financial statements of Banca Generali, "Annual Integrated Report ".

ESG RATINGS

MSCI

Rater: MSCI - Rating name: MSCI ESG RATINGS - Score: A - Scale (low | high): CCC | AAA

In 2023, Banca Generali received a rating of A (on a scale of AAA-CCC) in the MSCI ESG Ratings assessment*

The rating has steadily improved over the past 5 years

*The use by Banca Generali of any MSCI ESG Research LLC or its affiliates (“MSCI”) data, and the use of MSCI logos, trademarks, service mark or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of Banca Generali by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

S&P Global Corporate Sustainability Assessment

Banca Generali S.P.A. scored 60 (out of 100) in the 2023 S&P Global Corporate Sustainability Assessment (CSA Score as of 27.10.2023).

Banca Generali is also part of the Sustainability Yearbook 2024.

Sustainalytics

Rater: Sustainalytics - Rating name: SA ESG Risk Rating - Score: 6.1 (negligible) - Scale (low | high): 40+ (Severe) | 0 (Negligible)

In July 2024, Banca Generali SpA received an ESG Risk Rating of 6.1.

Copyright ©2021 Sustainalytics. All rights reserved.

Moody’s Analytics

Rater: Moody's

In September 2023, Banca Generali received an ESG Overall Score of 62/100 - Advanced by Moody's ESG Solutions. This assessment placed the Bank 5th in the ranking of the 97 companies within the Retail & Specialised Banks sector considered and confirmed its inclusion in the MIB ESG index, dedicated to Italian blue-chips and designed by Euronext and Borsa Italiana to identify the major listed national issuers with the best ESG practices.

ISS

Rater: ISS - Rating name: ISS Quality Score - Score: 1 Social, 2 Governance, 2 Enviroment - Scale (low | high): 1 (lowest G risk, most S and E discolusre) | 10 (highest G risk, less S and E disclosure)

To date, Banca Generali has received the following scores by ISS - Institutional Shareholder Services on ESG issues – environmental, social and governance with respect to the Quality Score:

- Social Score of 1, in which 1 is the highest level of disclosure and 10 is the lowest, thus obtaining the 'Quality Score Top Badge Social' for companies that have achieved the highest score;

- Governance Score of 2, on a scale in which 1 is the lowest level of risk and 10 is the highest;

- Environment Score of 2, in which 1 is the highest level of disclosure and 10 is the lowest.

Standard Ethics

Rater: Standard Ethics - Rating name: Corporate Standard Ethics Rating (SER) - Score: EE+ Very Strong (Outlook Stable) - Scale: EEE- Excellent | E- Unsatisfactory

In July 2024, Standard Ethics - specialized in the analysis of sustainable finance - has confirmed the "EE+ Very Strong" Corporate Standard Ethics Rating (SER) of Banca Generali, with a stable 12-month outlook.

The Bank appears to be aligned with most international sustainability strategies.

MEMBERSHIP

The Italian Sustainable Investment Forum (ItaSIF)

Banca Generali has been ordinary member of The Italian Sustainable Investment Forum (ItaSIF), one of the founding members of Eurosif (European Sustainable Investment Forum), since May 2019.

Founded in 2001, the Forum for Sustainable Finance is a multi-stakeholder non-profit association which promotes knowledge and practice of sustainable investment to spread the integration of environmental, social and governance (ESG) criteria into financial products and processes.

Principles for Responsible Investments

In December 2022, Banca Generali became a signatory of the PRI (Principles for Responsible Investments) promoted by the United Nations, confirming the commitment formalised in the Strategic Plan, in line with its Vision of aiming “To Be the No. 1 Private Bank by Value of Service, Innovation and Sustainability”.

The Principles for Responsible Investment (PRI) were launched in 2006 with the intention of fostering the spread of sustainable and responsible investment among institutional investors, and being part of the PRI network will allow Banca Generali to participate in a unique platform for dialogue with institutions and collaboration with industry peers.

UN Global Compact

At the beginning of 2024, Banca Generali joined the UN Global Compact, a voluntary initiative of the United Nations aimed at encouraging companies around the world to create an economic, social and environmental framework to promote a healthy and sustainable world economy that guarantees everyone the opportunity to share in its benefits. To this end, as a member, Banca Generali pledges to share, support and apply within its sphere of influence ten principles considered fundamental, relating to human rights, labour standards, environmental protection and anti-corruption.