2023 Global Corporate Governance Colloquium

Watch the Video Presentations here.

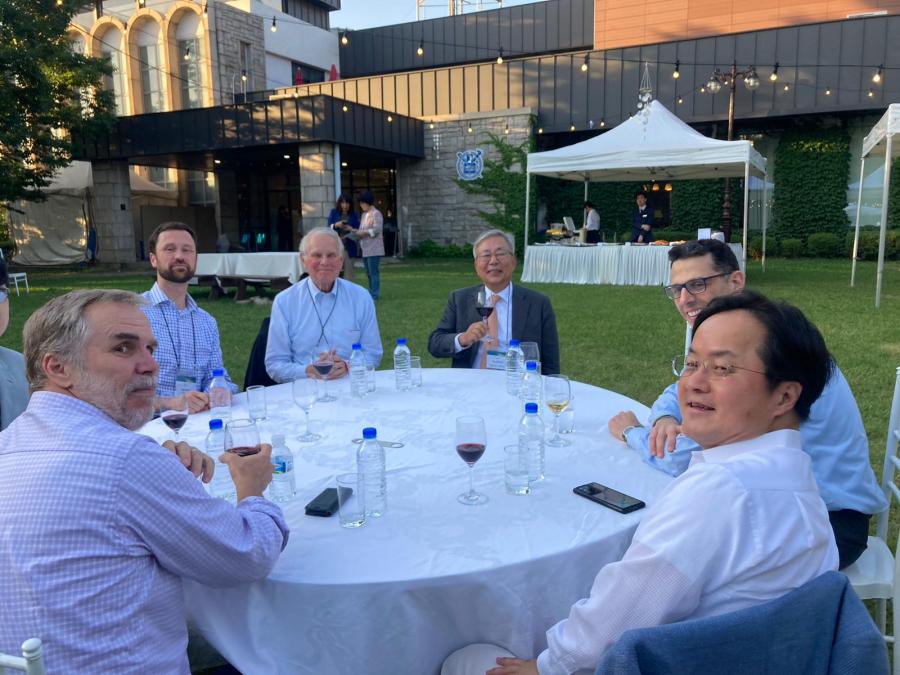

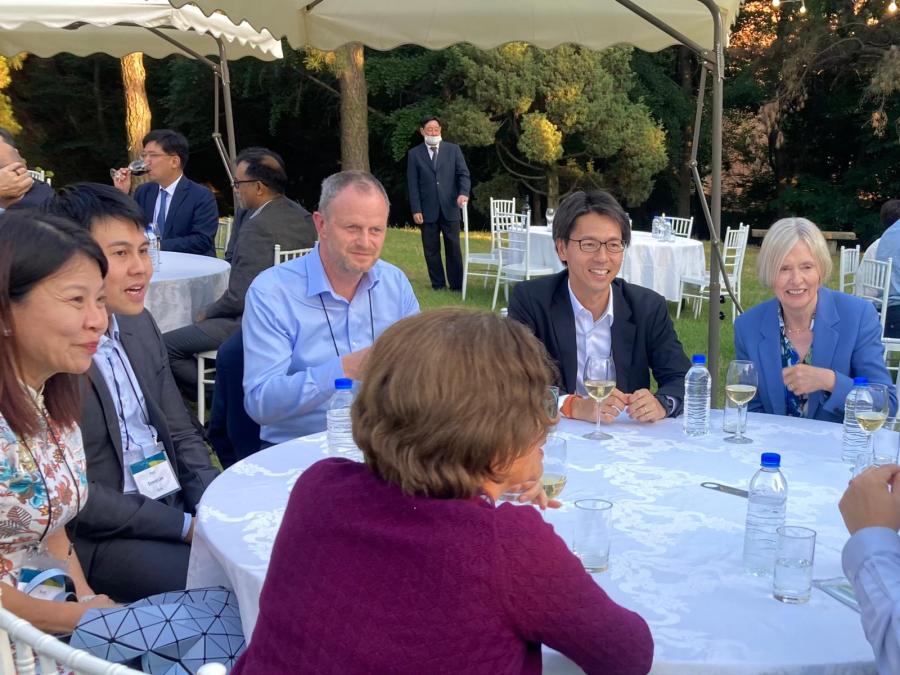

The ninth annual GCGC Conference was hosted by Seoul National University on 16 -17 June 2023 in Seoul, South Korea.

GCGC 2023, hosted by Seoul National University, offered a sophisticated understanding of how governance mechanisms can address contemporary issues. Themes of ESG integration, shareholder influence, and evolving regulatory pressures were discussed, presenting new insights into balancing economic performance with social and environmental responsibilities, underscoring the relevance of corporate governance research in an increasingly complex regulatory and socio economic landscape.

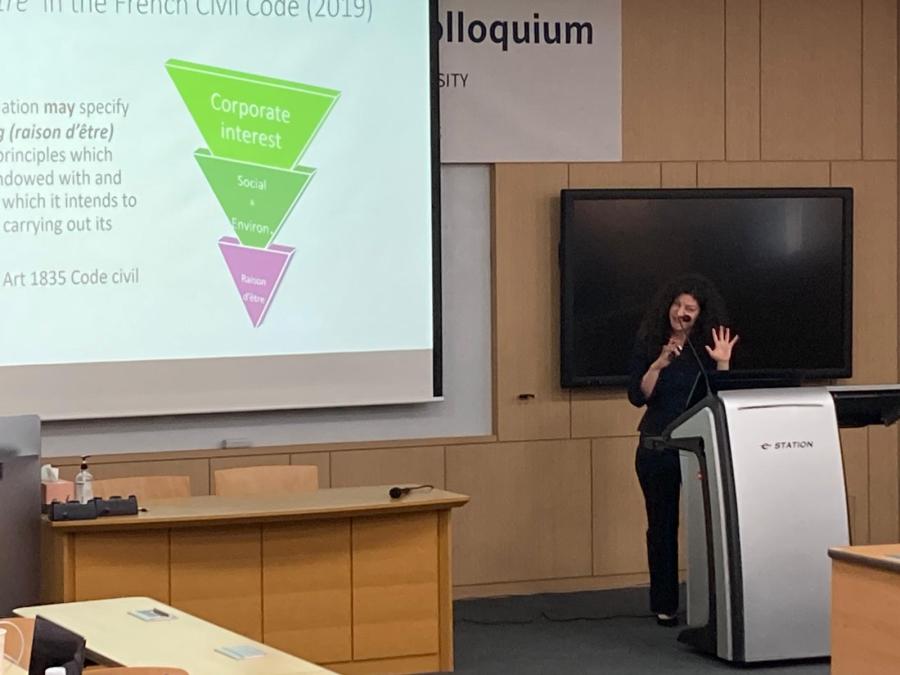

A central theme was the formalization of ESG, as highlighted in "The Hardening of ESG: Challenges and Opportunities" by Geneviève Helleringer and Christina Parajon Skinner. Their paper examined the shift of ESG practices from voluntary, principle-driven initiatives to increasingly binding regulatory frameworks in regions like the EU. They argued that this hardening of ESG practices raises potential legal and reputational risks for companies, suggesting that while regulatory rigor may enhance transparency and consistency, it could inadvertently stifle the flexibility and innovation that ESG policies once encouraged.

Another significant theme was the impact of governance frameworks on social goals, particularly in gender diversity. The study "Empower Women by Index Membership: Evidence from Japan" presented by Yupana Wiwattanakantang provided empirical evidence from Japan’s MSCI Empowering Women Index (WIN), demonstrating how index membership effectively motivates firms to improve gender diversity in the workforce, particularly at senior levels. The paper revealed that firms close to the inclusion threshold showed marked improvements in female representation and a shift toward more inclusive corporate cultures, as indicated by increased paternity leave uptake among male employees. This work emphasized the potential of targeted ESG indices to enact real social change without sacrificing profitability.

The conference also examined the relationship between corporate governance structures and firm innovation. In "Innovation: The Bright Side of Common Ownership," the authors explored how common ownership across competing firms in high-tech sectors can stimulate innovation by mitigating the “business-stealing” effect. However, in industries where market competition dominates, common ownership could suppress innovation efforts. This nuanced perspective on common ownership added depth to the debate, balancing competitive dynamics with innovation incentives.

Discussions on shareholder rights and defensive strategies featured prominently, particularly in the context of growing activism. "The Rise of Anti-Activist Poison Pills" by Eldar, Kirmse and Wittry, provided insights into how firms have adapted traditional defensive mechanisms, such as poison pills, to deter activist hedge funds rather than solely hostile takeovers. The study demonstrated that these anti-activist provisions, often implemented at low trigger thresholds, have successfully deterred activist interventions, highlighting the evolving nature of corporate defenses in modern governance.

Other themes included the impact of legal uncertainty on economic performance, highlighting how systematic legal uncertainty constrains credit supply; tenure limits for outside directors, finding that shorter tenures can lead to improved board independence and more frequent dissent against management particularly in poorly governed firms; and supply chain risks and vertical integration, showing that firms under high supply chain risk increasingly partner with local, reliable suppliers and, if financially able, pursue vertical mergers to strengthen their control over supply networks. Supply chain resilience has become a priority for governance, illustrating the need for more comprehensive risk mitigation strategies.

Note: This was an invitation-only event

Programme

Registration

Welcome Remarks

Speaker(s)

Session 1 | Chaired by

Speaker(s)

The Economics of Legal Uncertainty

Speaker(s)

Discussant

Outside Director Tenure Limit: Expertise-Enhancement versus Entrenchment

Speaker(s)

Discussant

Coffee break

Session 2 | Chaired by

Speaker(s)

The Hardening of ESG: Challenges & Opportunities

Speaker(s)

Discussant

The Global ESG Stewardship Ecosystem

Speaker(s)

Discussant

Lunch Break

Session 3 | Chaired by

Speaker(s)

The Rise of Anti-Activist Poison Pills

Speaker(s)

Discussant

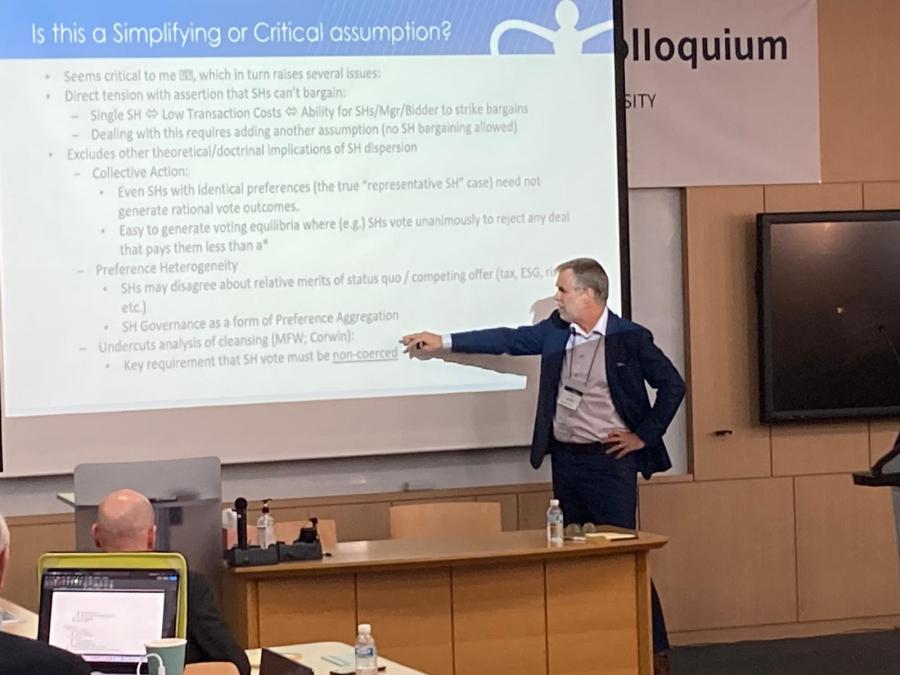

Shareholder Rights and the Bargaining Structure in Control Transactions

Speaker(s)

Discussant

Coffee break

Session 4

Panel Discussion: Pension Fund Stewardship

Moderator

Speaker(s)

Day 1 Concludes

Reception & Dinner

Registration

Session 5 | Chaired by

Speaker(s)

Coffee break

Session 6 | Chaired by

Speaker(s)

Governance Transparency and Firm Value: Evidence from Korean Chaebols

Speaker(s)

Discussant

Corporate Governance and Firm Value

Speaker(s)

Discussant

Lunch break

Session 7

Panel Discussion II: Shareholder Activism in Asia

Moderator

Panelist(s)

Coffee break

Session 8 | Chaired by

Speaker(s)

Innovation: The Bright Side of Common Ownership?

Speaker(s)

Discussant

Common Ownership Directors

Speaker(s)

Discussant

Concluding remarks and Reception

Speakers

Kenji Shiomura

Mina Yagi

Eilis Ferran

David Schoenherr

Charles Wang

Yupana Wiwattanakantang

Eric Talley

Pedro Matos

Martin Schmalz

Tobias Tröger

Marco Becht

Adriana Robertson

Johan Sulaeman

Presentations

Gallery

Contact