Exit or Voice? Time to take stock

Issue 5 | June 2023

Greetings from Brussels,

This year’s Annual General Meeting (AGM) or proxy season is slowly coming to an end and it is a good time to take stock of some interesting developments.

The number of ESG-related shareholder proposals remains high, particularly in the US. They cover a wide array of topics, including requests for specific emissions targets and reporting, corporate political activity and working conditions. While anti-ESG proposals have been steadily rising, their average support remains low with only 3-4% of the votes. ESG skepticism instead manifests itself in the declining support for the pro-ESG proposals.

Last month, 11% of Exxon shareholders voted for a proposal requesting the company to establish emission reduction targets aligned with the Paris agreement. The comparable proposal at Chevron received less than 10% of the votes. Last year these proposals still gathered 28% and 33% of the shareholders’ support and a proposal requiring an audited report on the effects of the energy transition on Exxon’s finances even passed with 52%. In the year prior to that the activist hedge fund Engine No. 1 made headlines by successfully installing three directors on Exxon’s board. On the other side of the Atlantic, 30% of TotalEnergies shareholders supported a proposal this year calling on the company to expedite its emission reduction. Similar proposals at Shell had likewise reached 30% in 2021, but support by shareholders dropped back to 20% at Shell this year and down to 17% at BP.

On average, support for climate-related proposals remained stagnant or has been dropping since 2021, both in Europe and in the US. There appear to be a number of reasons for this trend. Due to the energy crisis, all of the ‘big five’ fossil fuel companies experienced the most profitable year in their company’s history in 2022, making continued fossil fuel sales and investments appealing. Anti-ESG sentiments, especially in US politics, complicate the work of investors wanting to address climate risks in their portfolios. Another reason for the receding support may be that some climate-conscious investors have already sold their shares in these fossil fuel companies, thereby stripping themselves of the opportunity to advocate for change from within the company.

This brings me to the main question of this newsletter. If investors want to influence corporate outcomes in the presence of negative externalities, is it better to voice their concerns, or to exit through divestment?

Divestment sends a clear signal to politics and society and can be an effective tool to bring about change in a company. Public pledges to divest can cause the share price to drop and stigmatize the target company, urging it to adapt its business model.

In ‘Exit vs. Voice’, Broccardo, Hart and Zingales conclude that when the majority of investors are socially responsible and want to reduce negative externalities, voice actually achieves those outcomes better than exit, as it keeps the conversation going. However, when the majority of investors are ‘purely selfish’, voice becomes virtually ineffective and the effects of exit are limited.

Luckily, the effects of shareholder votes on corporate decision-making are not limited to the success of a proposal. Gathering 20-30% of support can already send a strong message to the management. In the UK, companies are required to report back on the actions they’ve taken on a proposed topic if 20% of shareholders had voted in support of it. Moreover, voting is not the only way through which shareholders can ‘voice’ their opinion. Both behind-the-scenes and public communication can be handy gadgets in the shareholder toolbox.

The effects of the various voice strategies can be enhanced by ‘coordinated’ or ‘collective’ engagement. Coordination can take place between large asset managers, institutional investors, hedge funds, impact-investment funds and in the form of platforms or alliances such as the PRI or Climate Action 100+. The combination of a lead and a supporting investor has shown to be an effective engagement strategy and can be facilitated by those platforms. Yet, last year Vanguard left the Net Zero Asset Managers Initiative (NZAM) and last month AXA and Allianz left the Net-Zero Insurance Alliance (NZIA), as a growing political opposition in the US raises concerns about antitrust violations.

Another, more fundamental concern is to what degree engagement can solve the underlying transition problems fossil fuel companies face. When the companies themselves ‘divest’, by selling the parts of the business that they won’t be able to align with their net-zero plans, they face a similar dilemma than divesting investors. The business does not cease to exist but it simply ends up in the hands of a less sustainability-minded owner.

A direct path out of this dilemma would be with legislation requiring companies to internalize those externalities, leaving it to the markets do the rest. While awaiting such stringent global legislation, what should socially responsible investors do in the meantime – voice or exit?

I’m curious to hear your thoughts.

Cordially yours,

Marleen

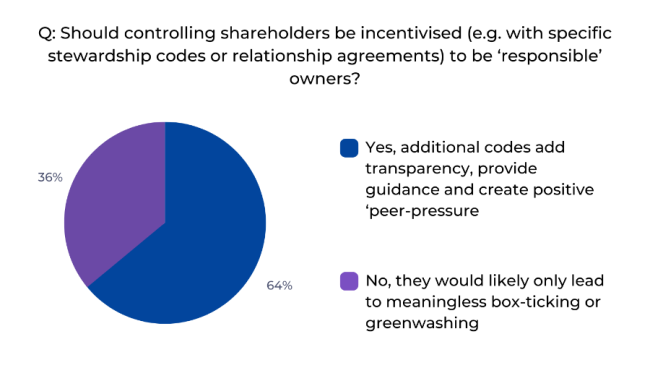

MINI POLL...

Q: If investors believe that their voice is insufficiently effective concerning negative externalities, is it better to?

A) Stay at the table and continue voicing their concerns

or

Marleen Och is a PhD researcher at KU Leuven, Belgium. She works in the field of sustainable finance and corporate governance, writing about shareholder engagement and sustainability.

Please feel free to get in touch, share your thoughts and let us know how we're doing, email Marleen.Och@ecgi.org and follow us on Twitter at @ecgiorg